Reading Time: 5 minutes

Reading Time: 5 minutes

Understand the significance of the COSO framework in your organization’s internal control strategy for improved governance, risk management, and compliance measures.

In today’s complex business environment, organizations face a multitude of risks ranging from financial misstatement and operational inefficiencies to regulatory penalties and reputational damage. A robust system of internal control is not just a matter of compliance; it’s a strategic imperative for survival and growth. But how do you build a system that is comprehensive, effective, and adaptable? For thousands of organizations worldwide, the answer is the COSO framework.

Originally established in 1992 and updated in 2013, the framework developed by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) has become the gold standard for designing, implementing, and assessing internal control. It provides a structured, principle-based approach that helps organizations of all sizes and industries achieve their objectives, navigate uncertainty, and act with integrity.

Implementing the COSO framework moves an organization beyond a simple “checklist” mentality for compliance. It fosters a deeper understanding of how different parts of the business are interconnected and how they can work together to manage risks and create value. This post will explore the core components of the COSO framework and outline why its implementation is crucial for building a resilient and well-governed organization.

The Five Interconnected Components of the COSO Framework

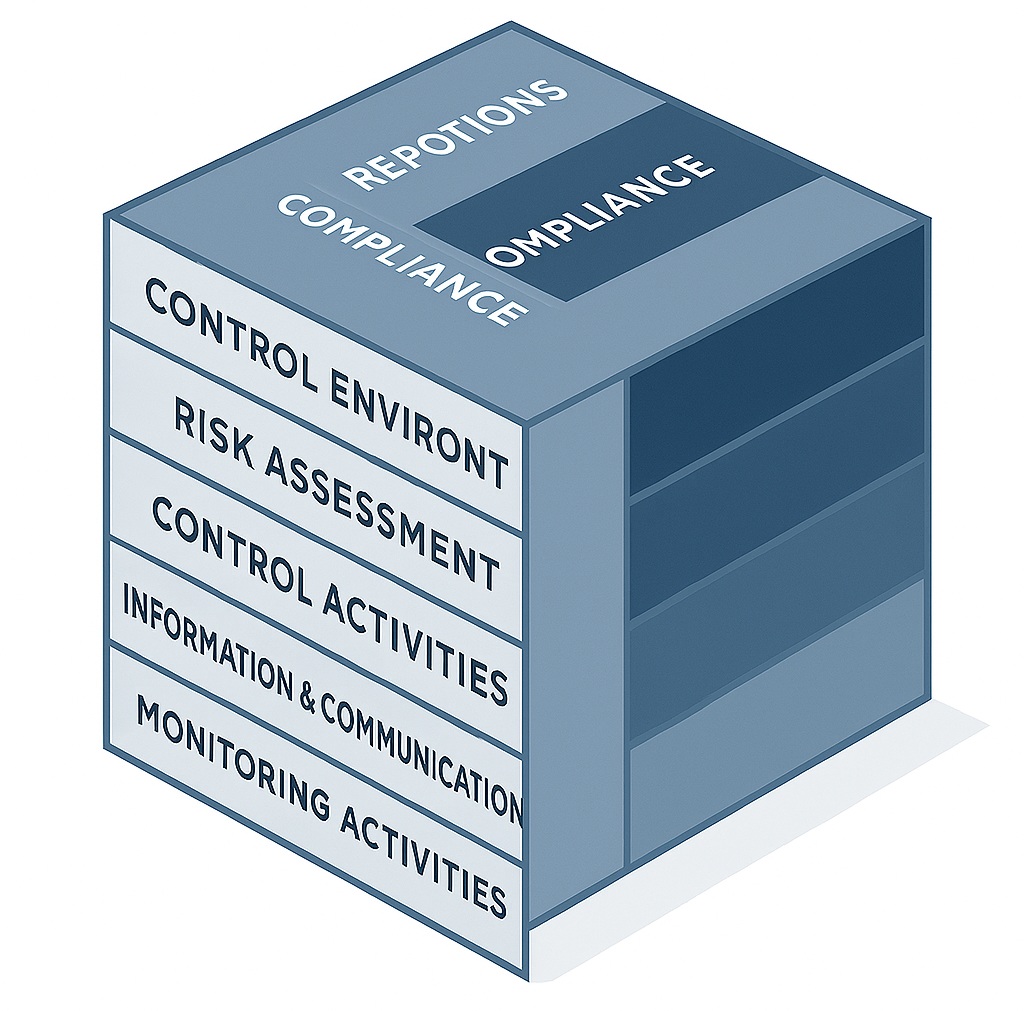

The COSO framework is famously depicted as a cube, illustrating the relationship between an organization’s objectives, its internal control components, and its organizational structure. At the heart of the framework are five integrated components that must be present and functioning together to create an effective system of internal control.

1. Control Environment

The Control Environment is the foundation upon which all other components rest. It represents the “tone at the top”—the set of standards, processes, and structures that provide the basis for carrying out internal control across the organization. It is about the ethical values, management philosophy, and commitment to competence that permeate the company culture.

- Significance: A weak control environment can undermine the entire system, regardless of how well other controls are designed. If leadership does not demonstrate a commitment to integrity and accountability, it’s unlikely that employees will.

- In Practice: This includes having an independent board of directors, a clear code of conduct that is consistently enforced, a well-defined organizational structure, and processes for attracting, developing, and retaining competent individuals.

2. Risk Assessment

Once a proper tone is set, the organization must identify and assess the risks it faces in achieving its objectives. Risk Assessment involves a dynamic and iterative process for identifying and analyzing risks from both internal and external sources. This isn’t just about preventing downside losses; it’s also about understanding the risks associated with missing opportunities.

- Significance: An organization cannot control what it does not understand. A thorough risk assessment allows management to focus its attention and resources on the most significant threats and opportunities.

- In Practice: This involves identifying risks related to operations (e.g., supply chain disruptions), finance (e.g., credit risk), and compliance (e.g., changing data privacy laws). The process should consider the likelihood of each risk occurring and its potential impact, forming the basis for determining how the risks will be managed.

3. Control Activities

Control Activities are the actions established through policies and procedures to help ensure that management’s directives to mitigate risks are carried out. These are the day-to-day controls that are embedded throughout the organization at all levels and functions.

- Significance: These are the “boots on the ground” of the internal control system. They are the practical steps taken to reduce the likelihood of a risk event or to minimize its impact.

- In Practice: Common examples include segregation of duties (ensuring no single individual has control over all aspects of a financial transaction), authorizations and approvals for expenditures, reconciliations of bank accounts, and physical controls over assets like inventory.

4. Information and Communication

For an internal control system to function, relevant and quality information must be identified, captured, and communicated in a timely manner. Information is necessary for the entity to carry out its internal control responsibilities to support the achievement of its objectives. Communication is the continual, iterative process of providing, sharing, and obtaining necessary information.

- Significance: Effective decision-making is impossible without reliable information. Furthermore, clear communication ensures that everyone in the organization understands their roles, responsibilities, and the importance of internal control.

- In Practice: This involves using reliable information systems, generating accurate financial and operational reports for internal management, and communicating policies and procedures clearly to all employees. It also includes establishing communication channels, such as a whistleblower hotline, for reporting suspected wrongdoing.

5. Monitoring Activities

The final component, Monitoring Activities, involves ongoing evaluations, separate evaluations, or some combination of the two to ascertain whether each of the five components of internal control is present and functioning. Findings are evaluated, and deficiencies are communicated in a timely manner, with serious matters reported to senior management and the board.

- Significance: The business environment is constantly changing, and so are the risks. Monitoring ensures that the internal control system remains effective over time and is adapted as conditions change.

- In Practice: This can include regular internal audits, continuous monitoring built into automated systems (e.g., flagging unusual transactions), periodic self-assessments by department heads, and management reviews of performance reports.

Why Prioritize the COSO Framework?

Implementing the COSO framework is a significant undertaking, but the benefits are clear and far-reaching:

- Improved Governance and Accountability: It establishes clear structures and responsibilities, fostering a culture of accountability from the boardroom to the front lines.

- Enhanced Risk Management: It provides a proactive and systematic way to identify, assess, and respond to the risks that can derail strategic objectives.

- More Reliable Financial Reporting: It is fundamental to regulations like the Sarbanes-Oxley Act (SOX), which requires public companies to maintain and report on the effectiveness of their internal controls over financial reporting.

- Greater Stakeholder Confidence: A demonstrated commitment to effective internal control enhances the confidence of investors, lenders, customers, and other business partners.

Conclusion

A Journey, Not a Destination: Implementing the COSO framework is not a one-time project but a continuous journey of improvement. It requires commitment, collaboration across all departments, and strong leadership. By embracing its principles, organizations can build a robust system of internal control that not only ensures compliance but also provides a strategic advantage, enabling them to operate more effectively, make better decisions, and achieve their goals with confidence and integrity.