Reading Time: 3 minutes

Reading Time: 3 minutes

Governance, Risk, and Compliance (GRC) is an integrated organizational strategy designed to manage corporate governance, identify and mitigate risks, and ensure ongoing compliance with industry standards and government regulations. It also refers to specialized software suites that help implement and automate this approach.

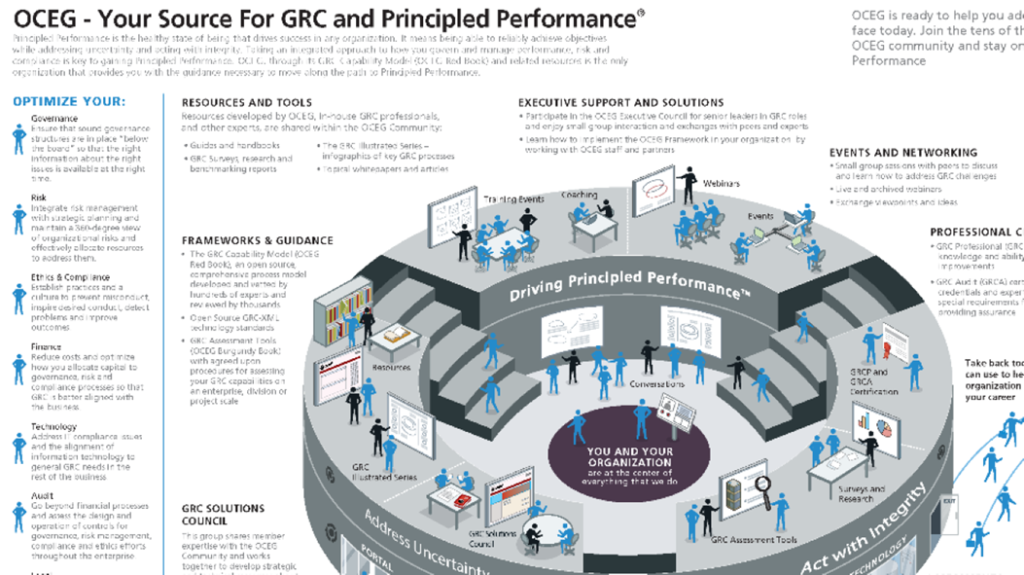

GRC originated as a term from the Open Compliance and Ethics Group (OCEG) in 2007. It provides a structured framework for aligning IT operations with broader business objectives, breaking down departmental silos, reducing duplication of effort, and enabling better decision-making through a unified view of risks and controls.

The Three Core Pillars of GRC

Source: About OCEG™ – OCEG

1. Governance

Establishes the rules, policies, processes, and controls that align business activities with strategic goals. It promotes ethics, accountability, resource management, stakeholder balance, and oversight of critical assets like data centers and applications.

2. Risk Management

Focuses on identifying, assessing, and controlling various risks—including financial, legal, strategic, operational, cybersecurity, and emerging threats like AI-related issues. The goal is to minimize negative impacts while maximizing opportunities, often as part of broader Enterprise Risk Management (ERM).

3. Compliance

Ensures adherence to external regulations (e.g., GDPR, SOX, industry-specific rules) and internal policies. It involves creating, updating, distributing, and training on policies while avoiding penalties, fines, lawsuits, and reputational damage through proactive monitoring and controls.

These elements interrelate closely: strong governance sets the foundation for effective risk management and compliance, while risk insights inform policy updates and compliance efforts create a feedback loop for better governance.

Key Benefits and Business Value

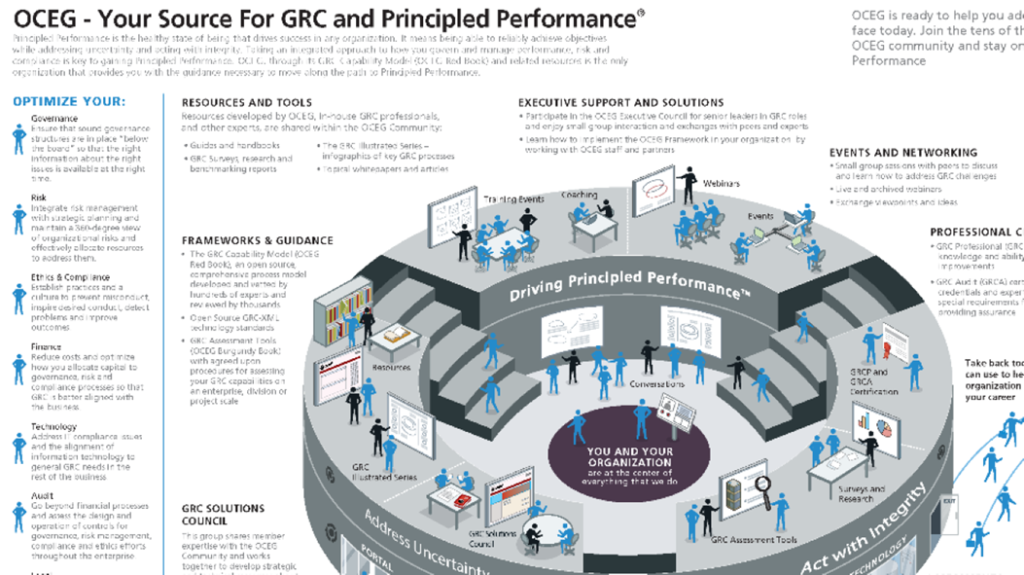

Source: How Do We Make The Business Case For Integrated GRC – OCEG

- Effectively manages IT/security risks and reduces uncertainty/costs

- Meets global compliance requirements—even for small- and medium-sized organizations

- Improves decision-making, resource allocation, and overall performance/ROI

- Automates assessments, audits, and monitoring to increase efficiency

- Supports strategic objectives across IT, Finance, HR, and executive leadership

- Prepares organizations for audits, third-party risks, AI model governance, and business continuity

Common GRC Use Cases

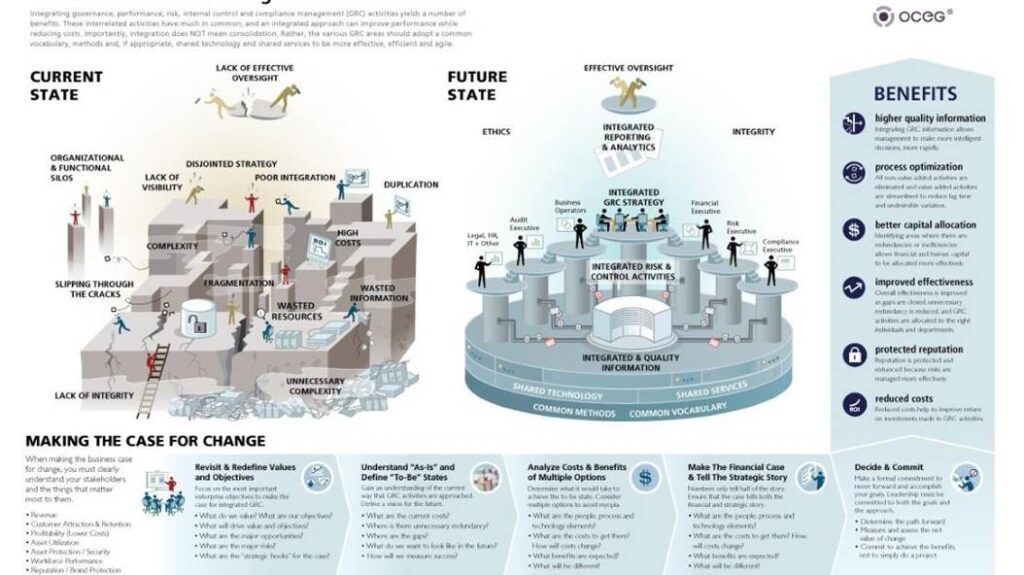

Source: Illustration – How Do I Know If Our GRC System Is Effective – OCEG

- Efficiency gains — Automate compliance tracking, policy management, audits, and AI/IT control monitoring

- Risk assessment & reduction — Automate risk scoring, prepare for regulations like Sarbanes-Oxley, and fix control gaps proactively

- Performance & ROI — Set/track metrics, resolve resource conflicts, and manage third-party ecosystems for better business outcomes

How to Implement a GRC Strategy

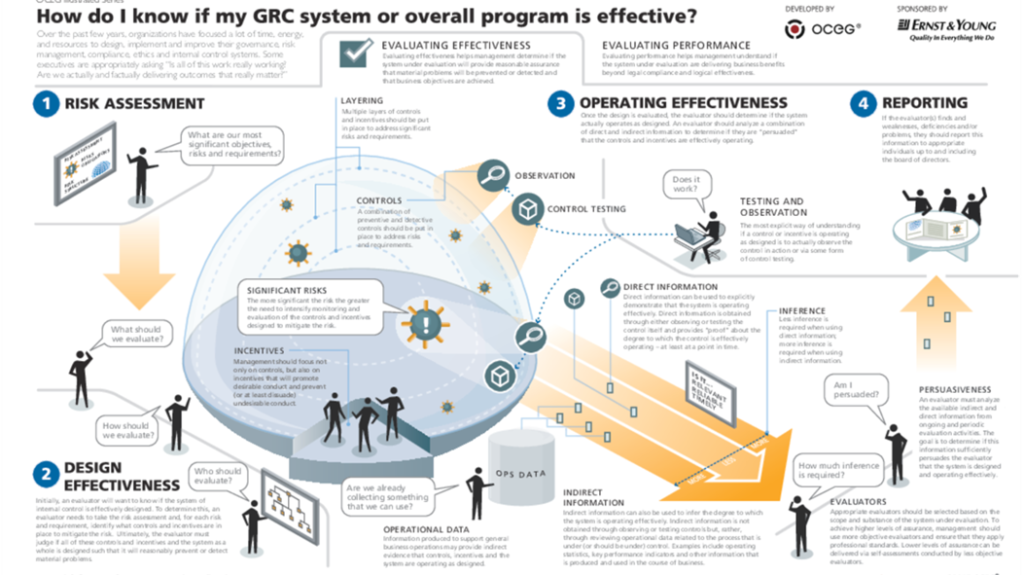

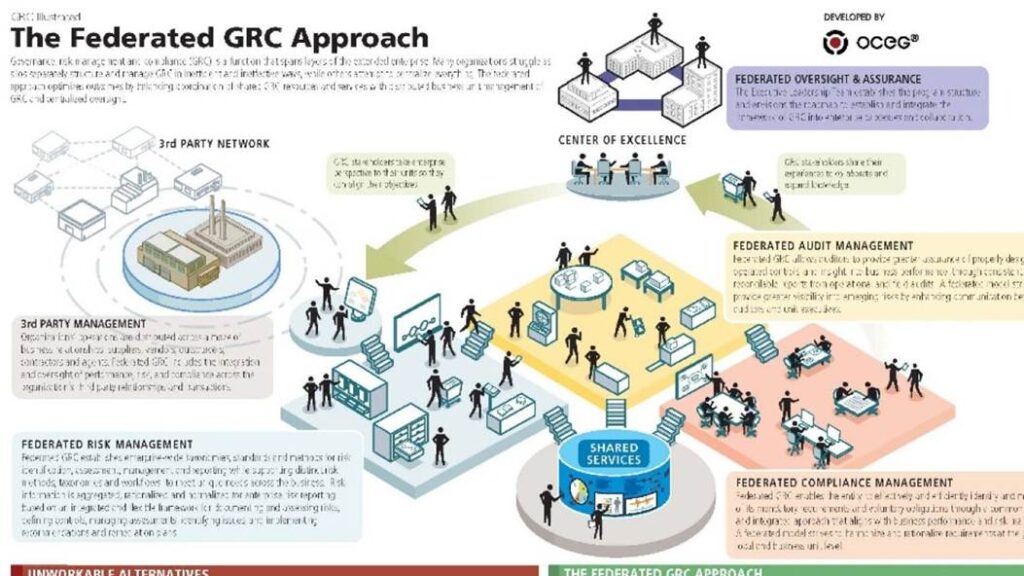

Source: Illustration – The Federated GRC Approach – OCEG

- Define clear goals and build a framework around key risks/challenges

- Identify operational gaps (e.g., security weaknesses or reporting failures)

- Secure executive buy-in for a risk-aware culture

- Gain organization-wide support and define clear roles (e.g., board oversight, Chief Risk Officer, compliance leads)

- Adopt specialized GRC software instead of manual processes

- Pilot in select areas before full rollout, with ongoing adaptation as risks and regulations evolve

GRC Software Tools and Features

Modern GRC platforms centralize processes with capabilities like:

- Document/content management

- Risk analytics and dashboards (KPIs, real-time insights)

- Workflow automation

- Audit management

- Regulatory update tracking

- Integration with SIEM, third-party tools, and AI for predictive insights